- Home

- About Us

- Functions

- Resources

- Tour Program

- Publication & Reports

- Contact Us

- Working with Us

- Circulars

- Employee Corner

- Women Helpline

Audit Reports

Compliance

Performance

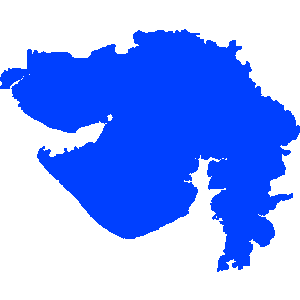

Gujarat

Report No. 2 of 2013 - Performance Audit on Revenue Receipts of Government of Gujarat

Date on which Report Tabled:

Tue 02 Apr, 2013

Date of sending the report to Government:

Government Type:

State

Sector

Taxes and Duties,Finance,Transport & Infrastructure,Power & Energy,Industry and Commerce

Overview

This Report contains 73 paragraphs including one Performance Audit relating to non/short levy of tax, penalty, interest etc. involving Rs. 348.22 crore. Some of the major findings are mentioned below:

The total revenue receipts of the Government of Gujarat in 2011-12 were Rs. 62,958.99 crore as against Rs. 52,363.64 crore during 2010-11. The revenue raised by the State from tax receipts during 2011-12 was Rs. 44,252.29 crore and from non-tax receipts was Rs. 5,276.52 crore. State's share of divisible Union taxes and grant-in-aid from the Government of India were Rs. 7,780.31 crore and Rs. 5,649.87 crore, respectively. Thus, the revenue raised by the State Government was 79 per cent of the total revenue receipts. Themain source of tax revenue during 2011-12 was Sales Tax/Value Added Tax (Rs. 31,202.31 crore) and stamp duty and registration fees (Rs. 4,670.27 crore). The main receipt under non-tax revenue was from non-ferrous mining and metallurgical industries (Rs.1,819.64 crore).

Irregular allowance of deductions towards labour charges from taxable turnover in 15 offices from 40 dealers resulted in short realisation of revenue of Rs. 1.66 crore.

In seven offices, the assessing authorities applied incorrect rate of tax in 12 assessments under Section 14-A resulting in short levy of tax of Rs. 100.42 lakh including interest.

In 19 offices, the dealer claimed excess/inadmissible deductions of labour, service charges in 23 assessments resulting in short levy/payment of tax of Rs. 4.01 crore including interest.

Incorrect exhibition of turnover and irregular deduction led to escapement of taxable turnover in 20 assessments in 12 offices, subsequently resulting in short levy of VAT of Rs. 4.72 crore including interest.

We noticed incorrect/excess grant of ITC ofRs.26.42 crore in 145 assessments in 53 offices.

In 15 offices, incorrect credit of ITC on opening stock in 28 assessments resulted in incorrect grant of ITC of Rs. 2.75 crore.