- Home

- About Us

- Functions

- Resources

- Tour Program

- Publication & Reports

- Contact Us

- Working with Us

- Circulars

- Employee Corner

- Women Helpline

Audit Reports

Compliance

Financial

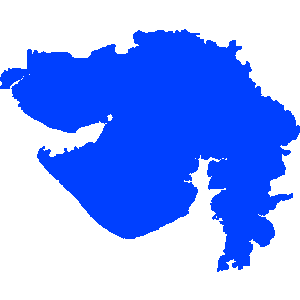

Gujarat

Report of 2012 - Compliance and Financial Audit on State Finances of Government of Gujarat

Date on which Report Tabled:

Tue 02 Apr, 2013

Date of sending the report to Government:

Government Type:

State

Sector

Finance,Industry and Commerce

Overview

This Report contains 24 paragraphs including one IT Audit on 'Haryana Registration Information System' and other observations relating to non/short levy of taxes, interest, penalty, non/short levy of excise duty, passenger and goods tax, royalty etc., involving tax effect of Rs. 527.46 crore.

The total revenue receipts of the State Government for the year 2013-14 were Rs. 38,012.08 crore as compared to Rs. 33,633.53 crore during the year 2012-13. Out of this, 80 per cent was raised through tax revenue (Rs. 25,566.60 crore) and non-tax revenue (Rs. 4,975.06 crore). The balance 20per cent was received from the Government of India as State's share of divisible Union taxes (Rs. 3,343.24 crore) and Grants-in-aid (Rs. 4,127.18 crore). There was an increase in Revenue receipts over the previous year by Rs. 4,378.55 crore.

Test check of the records of 250 units of Sales Tax/Value Added Tax, Stamp Duty and Registration fee, State Excise, Taxes on Goods and Passengers, Taxes on Vehicles and Non-Tax receipts conducted during the year 2013-14 showed under assessments/short levy/non-levy/loss of revenue aggregating Rs. 1,625.53 crore in 5,383 cases. During the year 2013-14, the Departments accepted under assessment of Rs. 20.89 crore in 771 cases. Of these, the Department recovered Rs. 2.09 crore in 310 cases for the cases of earlier years.