- Home

- About Us

- Functions

- Resources

- Tour Program

- Publication & Reports

- Contact Us

- Working with Us

- Circulars

- Employee Corner

- Women Helpline

Audit Reports

Compliance

Financial

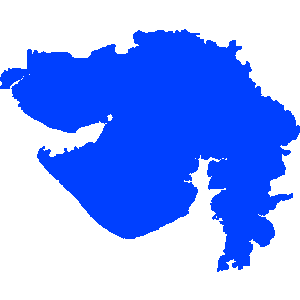

Gujarat

Report of 2009 - Compliance and Financial Audit on State Finance of Government of Gujarat

Date on which Report Tabled:

Tue 30 Mar, 2010

Date of sending the report to Government:

Government Type:

State

Sector

Finance

Overview

In response to the Twelfth Finance Commission's recommendations, the Gujarat Government enacted its Fiscal Responsibilities and Budget Management (FRBM) Act. entitled the Gujarat Fiscal Responsibility Act. 2005 with a view to ensure prudence in fiscal management and fiscal stability by progressive elimination of revenue deficit, sustainable debt management consistent with fiscal stability, greater transparency in fiscal operations of the Government and conduct of fiscal policy in a medium term fiscal framework. The State Government's commitment to carry forward these reforms is largely reflected in policy initiatives announced in its subsequent budgets. The benefits of FRBM legislation have been realised to a great extent already, in terms of reduction in major deficit indicators.

The State Government has done well in establishing an institutional mechanism on fiscal transparency and accountability as evident from the year-on-year presentation of outcome budgets. These outcome indicators tend to serve the limited purpose of measuring the department-wise performance against the targets. They do not. howev er, give the big picture of the status of financial management including debt position, off-budget liabilities, cash management etc. for the benefit of the State Legislature and other stakeholders.

The Comptroller and Auditor General's Audit Reports have been commenting upon the Government's finances for over three years since the FRBM legislation. Since these comments formed part of the Civil Audit Report, it was felt that the audit findings on State finances remained camouflaged because the majority of audit findings were on compliance and performance aspects. The obvious fallout of this all-inclusive reporting was that the audit findings on financial management did not receive proper attention. In recognition of the need to bring State finances to centre-stage, a stand-alone report on State Government finances was considered an appropriate audit response to this challenge. Accordingly, from the report year 2009 onwards. C&AG has decided to bring out a separate volume titled 'Report on State Finances.