- Home

- About Us

- Functions

- Resources

- Tour Program

- Publication & Reports

- Contact Us

- Working with Us

- Circulars

- Employee Corner

- Women Helpline

Audit Reports

Compliance

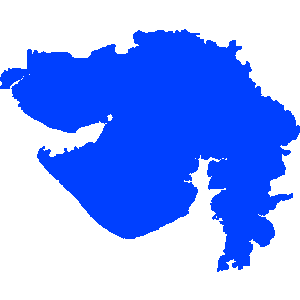

Gujarat

Report No.3 of 2017 - Revenue Sector Government of Gujarat

Date on which Report Tabled:

Wed 28 Mar, 2018

Date of sending the report to Government:

Government Type:

State

Sector

-

Overview

This Report contains 21 paragraphs including one Performance Audit involving ` 263.50 crore. Significant audit findings related to major state revenues are value added tax, stamp duty and registration fees, taxes on vehicles, etc.

The total revenue receipts of the Government of Gujarat in 2016-17 were ` 1,09,841 crore. The State’s revenue from tax receipts was ` 64,442.71 crore, from non-tax receipts was ` 13,345.66 crore, State’s share of divisible Union taxes ` 18,835.39 crore and grants-in-aid from the Government of India were ` 13,218.05 crore.

In the Performance Audit of “Grant, Levy and Collection of Receipts from Mining Leases” audit noticed a number of control deficiencies which had an adverse impact on the management of revenue. Gujarat Mineral Policy framed in 2003 has not been revised which resulted in a number of discrepancies including estimating the reserves of the minerals, etc. Due to the frequent changes in the Guidelines of 2011 issued by the Government of Gujarat for auction of blocks of minor minerals, the auction process was rendered faulty and a fair competitive bidding could not be ensured. There were 4,749 applications for grant of leases pending allotment as on 31 March 2016. Out of these, 3,543 applications (74.60 per cent) were pending for want of technical opinion from various departments. The percentage shortfall in yearly inspections of leases by the Department ranged between 74.24 to 89.86. In absence of adequate inspection of leases, the Department was unable to control the mining activities of the lessees.

In the Audit of “Evaluation and application of Annual Statement of Rates for determination of market value of immovable properties for levy and collection of Government revenue”, Audit noticed that Annual Statement of Rates (ASR) had not been revised during the period from April 2012 to March 2017 despite a Government of Gujarat Resolution dated 31 March 2011 that stipulated annual release of Annual Statement of Rates. Revenue in the shape of premium and stamp duty amounting to ` 67.33 crore could not be collected due to non-revision of ASR in respect of areas falling under Town Planning Schemes. Separate rates for commercial land in urban areas were not provided in the ASR due to which there was undervaluation of land. The survey process was found defective, the rates obtained through general enquiry were not cross verified with the computerised database of the system (gARVI). The survey data was unreliable as there were a number of unauthentic/ incomplete survey forms from which the rates of the land used for different purposes were entered into the ASR.