- Home

- About Us

- Functions

- Resources

- Tour Program

- Publication & Reports

- Contact Us

- Employee Corner

Audit Reports

Compliance

Performance

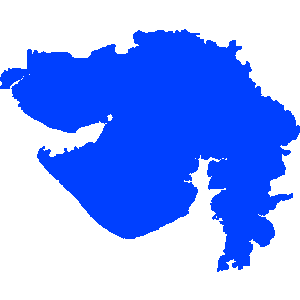

Gujarat

Report of 2011 - Performance Audit on Revenue of Government of Gujarat

Date on which Report Tabled:

Fri 30 Mar, 2012

Date of sending the report to Government:

Government Type:

State

Sector

Taxes and Duties,Finance,Transport & Infrastructure,Power & Energy,Industry and Commerce,Information and Communication

Overview

This Report contains 50 paragraphs including four Performance Audits relating to non/short levy of tax, penalty, interest etc. involving Rs. 462.98 crore. Some of the major findings are mentioned below:

The total revenue receipts of the Government of Gujarat in 2010-11 were Rs. 52,363.64 crore as against Rs. 41,672.36 crore during 2009-10. The revenue raised by the State from tax receipts during 2010-11 was Rs. 36,338.63 crore and from non-tax receipts was Rs. 4,915.02 crore. State's share of divisible Union taxes and grant-in-aid from the Government of India were Rs. 6,679.44 crore and Rs. 4,430.55 crore, respectively. Thus, the revenue raised by the State Government was 79 per cent of the total revenue receipts. The main source of tax revenue during 2010-11 was Sales Tax/VAT (Rs. 24,893.46 crore) and stamp duty and registration fees (Rs. 3,666.24 crore). The main receipt under non-tax revenue was from non-ferrous mining and metallurgical industries (Rs. 2,019.31 crore).

Performance Audit on 'Cross Verification of Declaration Forms in Inter-State Trade or Commercerevealed the following:

Though Declaration forms under the CST Act were being issued online

since July 2008 to the dealers, the phy sical position of the unutilised Declaration forms was not known, since this was not called back by the Department.

The TINXSYS website was not utilised for verification of forms till June 2011 and despite Departmental instructions, for its usage thereafter, we found instances where the Assessing officers were not utilising it effectively.

Internal control measures for cross verification of Inter State Trade Transactions in the form of Special Cell was absent.

Correctness of purchase transactions, involving revenue implication of Rs. 12.93 crore could not be ensured in absence of a system to check the utilisation of forms issued.

Evasion of tax to the tune of Rs.2.44 crore was noticed due to fraudulent utilisation of 'CForms/under-disclosure of Inter-State sales due to absence of cross verification system.

Non/short levy of Central Sales Tax ofRs.1.19 crore was noticed due to allowance of Branch Transfer on fake F' forms/over-declaration of branch transfer by the selling dealer in absence of system of cross verification of transactions.

There was Non/short levy of tax of Rs. two crore on inter-state purchase effected on fake 'Cform/under-disclosed Inter-State purchase.

We detected Mis-utilisation of 'F' forms which resulted in non/short levy of tax of Rs. 8.45 crore in absence of cross verification system.