- Home

- Circular & Orders

- About Us

- Functions

- Resources

- Tour Program

- Publication & Reports

- Contact Us

- Employee Corner

- Tenders and Bidding

Audit Reports

Compliance

Performance

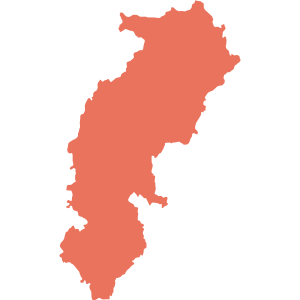

Chhattisgarh

Report No. 2 of 2019 - Revenue Sector, Government of Chhattisgarh

Date on which Report Tabled:

Thu 26 Mar, 2020

Date of sending the report to Government:

Thu 13 Feb, 2020

Government Type:

State

Sector

Taxes and Duties

Overview

This Report contains 14 paragraphs including a paragraph on ‘Preparedness for transition to Goods and Services Tax (GST)’. Total financial implication of the Report is Rs. 49.50 crore and Report is divided into six Chapters. The departments have accepted audit observations amounting to Rs. 16.64 crore and recovered Rs. 0.56 crore.

The total receipts of the Government of Chhattisgarh in 2017-18 was Rs. 59,647.08 crore. The State’s revenue from tax receipts was Rs. 19,894.68 crore, non-tax receipts was Rs. 6,340.42 crore, State’s share of divisible Union taxes was Rs. 20,754.81 crore and Grants-in-aid from Government of India was Rs. 12,657.17 crore. The State’s share of revenue receipts from own sources was 44 per cent.

Actual receipt was less than Budget Estimates by 1.67 to 72.97 per cent under revenue heads viz., Stamps and Registration Fees, Taxes on goods and passengers, Taxes on vehicles and Revenue and Disaster Management. Forest and Revenue & Disaster Management Department failed to provide any information related to outstanding arrears.

Audit of ‘Preparedness for transition to Goods and Services Tax (GST)’ revealed the systemic deficiencies such as in transitional credit cases, the dealers were allowed Input Tax Credit in excess of Input Tax Rebate shown in their VAT returns.

The Report also features our findings on application of lower rate of VAT which resulted in short levy of tax, concessional rate of tax allowed under Central Sales Tax (CST) Act without declaration forms ‘C’, exemption of tax allowed in transit sales under Central Sales Tax (CST) Act without statutory forms, entry tax short realised due to incorrect application of rate in Commercial Tax Department. Audit noticed Inadmissible exemption of Stamp Duty and Registration Fees under Chhattisgarh Special incentive scheme in Stamp Duty and Registration Fees Department and non realisation of Motor vehicle tax from the owners of vehicles in Transport Department. In Mining Department, Short levy of Stamp Duty and Registration Fees due to incorrect calculation of average annual royalty, and short levy of Stamp Duty and Registration Fees due to consideration of incorrect price of Aluminium were noticed. In Forest Department, selection of ineligible sites for plantation under Compensatory Afforestation Fund Management and Planning Authority (CAMPA), irregular and avoidable expenditure on Assisted Natural Regeneration (ANR) work in already treated coupe and Avoidable Expenditure was made on plantation in Protection Working Coupe under Green India Mission despite the plantation being prohibited according to the Working Plan of the Division were noticed.