XXVIIIth Accountants General Conference, 2016 & Symposium

Highlights of the Conference

- The 28th Accountants General Conference was held in New Delhi during October 20-21, 2016. The President of India, Shri Pranab Mukherjee inaugurated the Conference on October 20, 2016.

- Speaking on the occasion, the President said that the founding fathers of the Constitution had envisaged a prominent role for public audit in our country’s governance and accountability framework. Referring to the role of the Institution of CAG and its history of more than one and a half centuries, the President quoted Albert Einstein who had once observed, “It is important not to stop questioning.” The President stated that he was happy to be present in the precincts of an institution whose job is to question.

- The President said that public expenditure had increased manifold and the scope and range of governmental activities had multiplied exponentially. The unprecedented growth had obviously led to newer paradigms in public financial management. Concept of governance is rapidly changing and leveraging technology would enable the government to effectively reach out to the poorest of the poor. Increased use of technology platforms would help to ensure that benefits of Government schemes and programmes effectively reach the disadvantaged and financially excluded sections of society.

- Lok Sabha Speaker, Ms. Sumitra Mahajan, Public Accounts Committee Chairman, Prof. K V Thomas and CAG of India, Shri Shashi Kant Sharma also addressed the opening ceremony of the Conference. Shri ArunJaitley, Finance Minister, gave the valedictory address on the closing day of the Conference on 21st October 2016.

- About 200 Accountants General from all over the country, former CAGs of India, members of Audit Advisory Board, members of Government Accounting Standards Advisory Board and senior government officials attended the Conference.

- During the Conference, four groups of Accountants General deliberated upon the following four themes:

- i. Auditing the programmes related to Sustainable Development Goals

- ii. Meeting Challenges in Revenue Audit

- iii. Impact of IFMS on Accounts & Entitlement (A&E) Functions

- iv. Audit of Local Bodies: Perspectives & Concerns.

i. Auditing the programmes related to Sustainable Development Goals (SDGs)

- On 25th September 2015, the United Nations adopted the agenda “Transforming our World: the 2030 Agenda for Sustainable Development” with Member States committing themselves to achieving sustainable development in its three dimensions – economic, social and environmental – in a balanced and integrated manner.

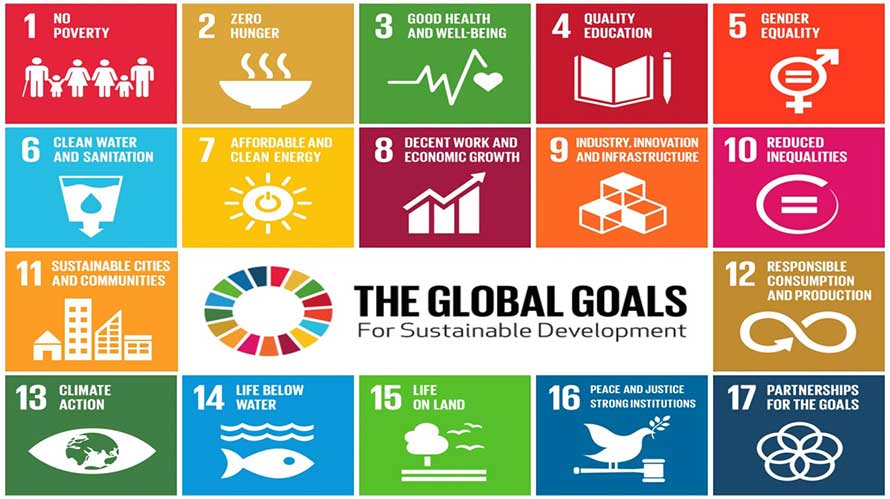

- While SDGs are not legally binding, governments are expected to assume ownership and establish national frameworks for achieving them. The SDGs came into force on 1st January 2016.There are 17 defined SDGs accompanied by 169 related targets and over 240 indicators.The 17 SDGs are listed below:

The group made a number of recommendations regarding the auditing of programmes related to SDGs.

ii. Meeting Challenges in Revenue Audit

- Taking cognizance of the fact that the themes related to Revenue Audit had hardly been discussed in the previous conferences, the discussion in this group was aimed at changing the mindset of revenue auditors, looking beyond the Department of Revenue, accessing records of the assesses, big data and use of data analytics. The Group took note of the fact that there are issues other than GST that need to be addressed such as tracking the parallel economy/ black money sources and challenges from digital economy/ e-commerce in the Indian context. The Group made a number of recommendations on Revenue Audit which will be examined for appropriate action.

iii. Impact of IFMS on A&E Functions

- IFMS is a web-based financial accounting system initiated in 2010 under National e-governance plan of Government of India. The first step in this initiative was the Treasury Computerisation Project which was taken up by State governments with funding from Government of India. Integrated Financial Management System (IFMS) is an extension of the Treasury Computerization Project. It is a complete application software package that enables online real time management, monitoring and control of all fund allocations and financial transactions in different departments and subordinate offices of the State Government.

- Taking note of the fact thatthe IFMS of each state is likely to be unique, with independent IT platforms, hardware & software, processes and requirements, the Group made a series of recommendations to deal with the issues arising out of implementation of IFMS in the states.

iv. Audit of Local Bodies

- Local Bodies comprising PRIs and ULBs form the third tier of government. These present a unique challenge for the institution of CAG, which is not the primary auditor for local bodies notwithstanding that these bodies have been receiving increasingly higher financial devolutions from Central as well as state governments. Amongst the various issues discussed, an area of special focus was social audit as an instrument of accountability. The issues taken up during the discussion included:

- i. Effectiveness of Technical Guidance and Support (TGS)

- ii. Accounts of Local Bodies

- iii. Reporting Mechanism

- iv. Improvement in the quality of LB audit

- v. Audit focus on the effectiveness of citizen centric services delivered by ULBs

- vi. Social Audits.

The recommendations made by the Group are being examined for appropriate action.

|