Valediction Speech by Finance Minister

The Hon’ble CAG Mr.Mehrishi, Hon’ble Dy. CAG, Ladies and Gentleman:

As Mr. Mehrishi mentioned, I have had the privilege of interacting with you on your biennial Conference on the last two occasions, and its indeed a privilege to be here because when you have this two days session and focus on the institution building of the CAG on basis of your experience of past 2 years,... it only adds to the credibility of CAG as an institution. There are two fundamental principles which I understand, which reflect on the functioning of the CAG. The first of course is that government resources are sacrosanct, they are to be spent in public interest, there is no futility of government resources possible; there is no leakage of it which should be permitted and any diversion for extraneous factors can never be tolerated. The second of course is when with the wisdom of hind sight, after the sacrosanct resources have been spent, with a magnifying glass the CAG looks at each transaction, it really has the purpose of both serving as deterrent, deterrent on decision makers because there is possibility at some stage in future of every decision that they take, would be examined by somebody and that is probably the reason why reports of the CAG have acquired a great amount of credibility in the past and it’s an onerous responsibility on you that in every changing environment to make sure that this credibility is maintained on the strength of the quality of the report itself.

Many of us who have held public offices in the past or at present have indeed been impacted by this accountability which is inbuilt in the system, and therefore, every time we take a decision the factors which go into our own minds and I will say this from personal experiences that the decision which we take, must be informed by reason that tomorrow if somebody analyses it he should be able to dissect our process of thinking and decide as to why this decision was taken, the decision should be motivated in larger public interest, where is the larger public interest in a particular decision and of course third one, that the procedures you follow must be absolutely fair. They must themselves inspire confidence. I think it is this criteria which is essential aspect of good governance in India and when you do a post-mortem of any transaction you do it years after the transaction has been undertaken, your post mortem also are really based on procedural fairness, the rationality in the reasoning why a decision has been taken and whether it has sub-served larger public interest or otherwise. Therefore, I do believe that your role in future is going to continue and expand, and there is reason in itself. The reason itself is that Government resources in this country are going to expand. There is no question of their being static or narrowing down. They are going to be expand at a much faster pace in the years to come. The reasons for this expansion are absolutely clear. The economy has been increasingly becoming formalised. In an informal economy, large amount of non-tax of compliance takes place, predominance of cash is there and as the economy gets formalised with each day you move in the direction of the government being able to bring more and more people into the formal sector of the economy. There is a second reason also. The second reason is what the CAG mentioned in his opening comments that this is an age where technology is an opportunity. Even for countries like us which missed on more than one occasion the industrial revolution, at least we have been fortunate that we didn’t allow ourselves to be bypassed by the technology revolution itself. Therefore in the last two and a half decades, millions and millions of Indian have shown a natural aptitude for technology. So our governmental system, our private sector systems and with each passing on generation, the age of being technology oriented really has declined now. So the younger generation is far more equipped. The result of this is, the formalisation itself and formalisation has been accelerated by the large number of recent steps that we took. If we look at the functioning of the direct tax department, something that you audit regularly, various factors, there is a factor in terms of strict compliance also, there is a factor in favour of rationalisation of tax structure, lowering the lowest slab and the result of that has been that we are finding anything between 15% to 20% gradual increased in tax collection every year. Four years ago when we assumed office the figure that used to bite our minds used to be the total number of the people who file a tax return in India was 3.80 crore. It is already 6. 86 crore last year, in four years. In five years, I do hope it is something close to 7.6 or 7.5 crore, which means in 5 years we would have doubled the number of people filing tax returns in India. So the day when Income Tax Act came into force till 2014, the number of people who got into the net. All these factors - the anti-black money measures, the formalisation of economy, the use of technology, the ability to detect transactions, the compulsion which the demonetisation created on a lot of people to have deposited the moneys in the banks, so they have to, in terms of taxation, account for it. Obviously the collection will then increase every year 15 to 20 per cent. The GST itself, in the field of indirect taxation, has brought in many more assesses than there were in the pre-GST issue. It’s not a part of your brief, but if somebody outside did an audit of delaying some of these decisions with regard to the use of technology in both direct and indirect taxes, how much has this the cost this country, and where does this money then go. With this expansion if you have a 74 per cent increase in the number of assesses in the first one year itself, how you use these additional resources in a larger public interest? There are fixed expenditure of the States, the States Government have to repay back their past debt, they have to service it with interest, nobody can alter those amounts, salaries and pensions have to be paid, and then you have to have the devolution to the States, the defence and national security expenditure is a fixed expenditure, which is bound to increase and we are bound to increase our spending on that and after these fixed expenses, the residuary really remains for the developmental activities. These are developmental activities whether in form of resources spent on infrastructure or resources spent in social sector or the rural sector for the benefit of socially and economically weaker sections of society. A lot of this is done through the CSS Schemes through the Sates itself. The power of technology itself is that now you can trace out with the new system whether these moneys spent to a department of the central government or to a State is only part somewhere or is it being utilized for the targets itself.

The Aadhaar itself being a technology based system have ensured, have the capacity to ensure that the leakage doesn’t take place, the misuse of the diversion doesn’t take place, so the benefit goes into the bank account of the recipient itself. The result of this is going to be that we today in 2018, if you are looking at these expansions when these reforms have only recently taken place and we looked down the tunnel at India after 10 years, India, after 15 years, and 20 years, look at India in 2030, look at India in 2040, the CAG will still be here to conduct his audits. So the quantum of money being spent, either on infrastructure projects or defence purchases or on social sector schemes, directly or through the States, is going to multiply. And that’s why I said States’ resources, are sacrosanct. We can’t afford to waste a single rupee out of it. Once we can’t do that, the systems which you must have in place is to ensure that there is no flexibility available with those in Government at any point of time to allow this resource to be diverted somewhere. So the systems that you audit and make recommendations for the future are the ones which are going to ensure you that it is this resource which is going to bring out millions and millions of our people out of poverty, and therefore, the quality your reports and when they go to the Parliament, through the Public Accounts Committee and when they are merged with the recommendations of the Public Accounts Committee, the consideration which the Governments, both at the Centre and State give to them has to be of top priority, so that we make sure that this is not something which is adversarial, this is something which is only intended to improve the quality of governance. Where are then the challenges? So far so good. I think one of the big challenges is that even though we are growing as an economy, compared to our counterparts in the world, we are the largest democracy with free expression. We still have to improve both our understanding of issues and the quality of public discourse. The quality of public discourse has to mature itself. It has to rise beyond slogans, it has to rise above propaganda and there has to be a certain amount of depth which has to be added to the public discourse. Therefore, any transaction or every transaction without understanding the same, I find these days that the maximum comments come from people who only understand the issue on the surface without going down, even to the first layer of it. The GST itself checks evasion. It brings in more people. The demonstration brings money operating outside the system into the banking system. Therefore, acts as a deterrent against those who are used to a different kind of functioning. The formalisation of the economy eventually is going to help each one who gets into the system. The Aadhaar will be used as a platform not for snooping at people, as some people try to hijack the debate, for the Aadhaar will be used as a platform, in order to ensure that subsidies don’t remain an unquantified amount meant for an unidentifiable section of people but subsidies are a specific amount and must reach the targeted beneficiary itself. That was the principle purpose and that is how it became a money bill and the majority of four judges accepted that in the Supreme Court. Therefore, when we are getting into this age of technology, this age of width of resources, this age where India becomes the fastest growing economy in the world targeting itself as one of the biggest ones in the world, I think, we need parallelly to educate ourselves on the quality of discourse, and the discourse can’t be merely limited to a one line tweet or understanding the issue on its surface but in a detailed in depth analysis. Therefore, I would certainly suggest that when the CAG uses all these factors - technology, keeping track, post-morteming the transaction itself, making recommendations where they are due, expressing a strong opinion where they think there have been breaches, then we have to allow this go to the Public Accounts Committee and the recommendations then have to be implemented. That is why your contribution to improve the quality of discourse and help our people and policy makers to understand, it has to be, that even on complicated technical issues, the reports are worded in a manner that they could be understood easily, there is no ambiguity, there are no loose sentences, so that the whole report is in one direction, one loose sentence is picked up and hijacked not so much over a public discourse and therefore, a larger public interest which your report has to subserve really gets by-passed itself. I think it is a duty of every institution. Governments in terms of policy initiatives over the last, at least, 27 years since 1991 have reformed themselves. Other institutions like yours which are independent and autonomous discharge their own functions, have grown in stature, increased their ability, in terms of quality of the personnel available and in the use of other instruments of dissecting transactions. There is one last area I wish to point out, and I am just setting off a discourse on it. It’s not necessary that I have a fixed view. You did refer to your transactions of a large number of Public Sector Undertakings both at the Centre and States which function. I think we have to really think in terms of the future road map of how they function. We created a legal regime for our PSUs, in the pre-1991 environment. Therefore, a large number of them in pre-1991 function in a monopoly environment. The fields were wholly occupied by them. Airlines is an example, petroleum sector is an example, you will find a various examples across sectors, mining itself is an example. Post 1991, when we started de-licensing we opened our sectors to the private sector, and in a large number of cases we went beyond the private sectors opened them out for foreign investors itself. Now in sectors where there are public sector players and private sector players, the environment for functioning for the two is entirely different. In ones the transactions are audited by you and in others they are not, one has to give contract purely, on tendering and the others are note, one can go to the campus make a direct recruitment and the other have to hold a written examination and then hold interviews and settle for the next best. I can go on endlessly counting. Now the legal regime was not necessarily fixed by the Government, it was also fixed by judicial pronouncements and it was fixed by a judicial pronouncement which said that public sectors are also instrumentalities of the state and therefore they are all bound by the constrains of various constitutional provisions, Article 14 and so on. This was very good when they were functioning in a monopoly environment because it added a sense of responsibility to do their functioning. But if a public sector airline and a private sector airline has to be function with two different sets of regulations, a public sector shipping company and a private shipping company, if the shipping cycle is high and he wants to sell a ship, by the time the public sector company sells the ship, the shipping cycle itself has changed.

So, I think we have still not paid enough attention to this chaining of the public sector by the legal regime that we have done, particularly in sectors where they are competing. Therefore this impacts on their performance, this impacts on the time table, whereas the private sector itself, rightly so, is free from these. I think our entire system whether it is the CAG or the Government of India or it is a judicial pronouncement, time has now come for us to use some mind space, that the pre-91 regime of their functioning in a monopoly environment is entirely different from their functioning in a competitive environment. It we want them to exist, survive, and survive with full financial strength, then how do we allow them a level playing field itself. Now the dangers of that level playing field again will be pointed out with - you spend a public fund and therefore a difference regime will apply and the consequences then is a vicious circle. I have not found a defensive answer to this myself. But I think, as even India move towards the next round of reforms, there always will be areas for purposes of oil security, areas like the railways or several other areas where public sector will always remain, has to think how do we reform ourselves from this path or otherwise their financial strength itself will be greatly strengthened. We have recently amended the Prevention of Corruption Act. After a great deal of deliberation the Parliament has amended it. It will certainly help us in expediting decision making as far as the Government is concerned. Now these are all areas where what are the standards CAG is going to apply on some of the quick decision making which are to take place? You allow a public responsibility to somebody to make sure that industries don’t collapse and don’t allow the economic system of the country to be adversely impacted. Are we now in a position to allow them the freedom to take quick decisions, come to quick settlements because the markets don’t wait for the entire procedural formalities to be completed, because if we waited for all that the markets would have collapsed before the decision itself is taken. Therefore, these are all situations being thrown up which will require a more radical thinking and I am sure in your future deliberations this is one area which will occupy your mind space.

Thank you very much for this opportunity given to me to be amongst you once again for this conference.

Continue Reading

From the Editor's Desk

The tenth issue of the Journal of Government Audit and Accounts is a special edition that presents highlights of the 29th ...

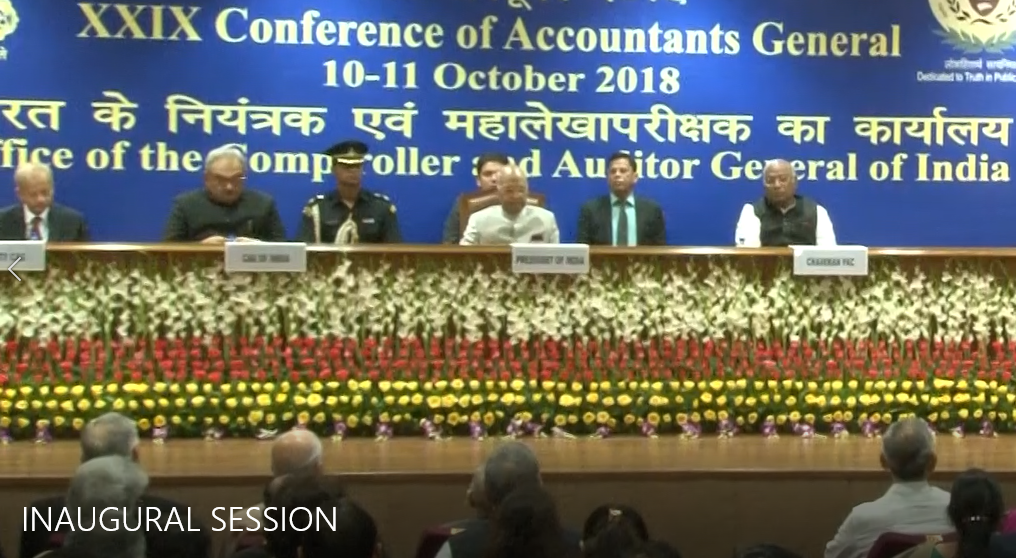

Welcome Speech by Comptroller & Auditor General of India

It is an honour and privilege for me to welcome all of you on behalf of our 48000 strong family to this inaugural...

Inaugural Speech by President of India

I am happy to be here for the 29th Accountants General Conference. This is the right occasion and opportunity to introspect...

Theme Papers

The main theme 'Auditing and Accounting in a Digital Era', was further sub-divided into four sub-themes (i) Audit Planning, (ii) Audit Execution, (iii) Audit Reporting, and (iv) Accounting in a Digital Environment...