- Home

- About Us

- Functions

- Resources

- Tour Programme

- Reports

- Contact Us

- Employee Corner

- IBEMS

- CAG CONNECT

Audit Reports

Compliance

Financial

Performance

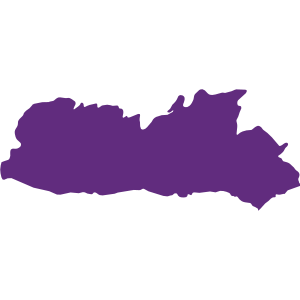

Meghalaya

Report No. 1 of 2015 - Compliance and Performance Audit on Revenue Sector of Government of Meghalaya

Date on which Report Tabled:

Wed 25 Mar, 2015

Date of sending the report to Government:

Government Type:

State

Sector

Taxes and Duties,Finance,Transport & Infrastructure,Power & Energy,Environment and Sustainable Development

Overview

This Report contains a Performance Audit on "Working of bonded warehouses and distilleries/brewery (including bottling plants" and 29 paragraphs relating to under assessments/non-realisation/short realisation of penalties, taxes, duties etc. The total money value involved is RS 165.82 crore. During the year 2013-14, the total revenue raised by the State Government (RS 1547.44 crore) was 24.69 per cent of the total revenue receipts (RS 6266.69 crore). The balance 75.31 per cent of receipts during 2013-14 comprised State's share of divisible taxes and duties amounting to RS 1301.96 crore and grants-in-aid from Government of India amounting to RS 3417.29 crore. The revenue raised by the State Government in 2013-14 was higher by 16.12per cent as compared to 2012-13.

Test check of the records of taxes on sale, trade etc., state excise, motor vehicles tax, forest receipts and other non-tax receipts conducted during the year 2013-14 revealed under assessments/short/non-levy/loss of revenue amounting to RS 598.25 crore in 283 cases. During the year, the departments accepted under assessments/short/non levy/loss of revenue ofRS 439.19 crore in 213 cases pointed out in 2013-14, and recovered RS 0.34 crore.

A dealer concealed RS 4.11 crore by furnishing revised returns which led to evasion of tax of RS 0.51 crore on which interest of RS 0.73 crore and penalty of RS 1.02 crore was leviable. Due to failure of the ST to complete assessment in time, a dealer concealed purchase of RS 3.33 crore and evaded tax ofRS 0.42 crore on which interest ofRS 0.68 crore and penalty ofRS 0.84 crore was leviable, leading to a loss of revenue. Due to failure of the ST to complete assessment in time, a dealer irregularly claimed ITC on purchase of Schedule-V goods resulting in short payment of tax of RS 5.01 crore on which interest ofRS 7.62 crore and penalty ofRS 10.02 crore was leviable, leading to a loss of revenue.